by Sheral Reddy, Associate Director at GECA Chartered Accountants. If you need help with tax advice including end of financial year preparation, then Sheral and the GECA team can help.

Tax Updates

Depreciation on Non-Residential Buildings

In our earlier newsletters we have mentioned reintroduction of depreciation on commercial properties from 2021 financial year as part of the changes enacted in the COVID-19 Response Act 2020.

The deprecation rule applies to non-residential buildings owned at the beginning of the 2021 financial year or acquired after the beginning of that financial year. This includes capital improvements as well.

The depreciation rate for a building with an estimated useful life of 50 year or more is 2% diminishing value or 1.5% under the straight-line method.

Tax depreciation of buildings was removed as per the 2010 Budget and came into effect from 2012 financial year. Going forward, any tax losses on disposal of the building will still be non-deductible. If the building is sold more than its tax book value, the tax depreciation claimed previously prior to 2012 years (if any) will be recoverable.

The depreciation recovery calculation will also apply for non-residential buildings disposed after the beginning of the 2021 financial year to account for any depreciation deductions during 2021 and future years.

The depreciation deductions will be based on the opening tax book values of the building at the beginning of the 2021 financial year.

For buildings that were already owned at the end of the 2011 financial year, the tax book values will be based as follows:

- Adjusted tax book value at the end of that year less any deductions for fit-out that has already been claimed, plus

- Any non-deductible capital expenditure on the building incurred from the beginning of the 2012 financial year till the end of the 2020 financial year.

For buildings acquired after the tax depreciation was removed from the 2012 financial year, the value would be based on:

- The cost of the building, plus

- Any non-deductible capital expenditure on the building incurred from the time it was acquired to the start of the 2021 financial year.

The reintroduction of depreciation on non-residential buildings provides tax payers a huge tax savings. However, it is important that clients are calculating the tax depreciation of the depreciable assets using the correct opening tax book values.

Please contact your GECA Advisor on 0800 758 766, if you would like to claim depreciation on your non-residential buildings and how the tax depreciation will impact your tax position going forward.

Determination EE002 – Payments to Employees Working from Home

The determination EE002 is a temporary response to the Covid-19 pandemic and applies to payments made for the period from 17 March 2020 to 17 September 2020 as there may be tax implications associated with these payments.

Reimbursement of expenses to employees related to working from home is not an employment right, therefore, the payments depends on what the employer has negotiated with their employees.

There are employers who are or intend to make payments to employees who are working from home due to the Covid-19 pandemic. Below is a brief outline of this new determination and to clarify the tax treatment of the payments:

- Employers are able to make tax free payments of up to $15 per week without the need to work out the actual expenses.

- In addition, Employers can make a tax-free payment of up to $400 per employee for furniture or equipment without the need to work out the actual expenses.

- The determination also acknowledges that many employers will not be in the financial position to make additional payments to employees during the COVID-19 pandemic. Therefore, this determination is not intended to suggest that employers should make such payments to employees.

- Such payments from the employer may be exempt income for the employees. The amount that can be paid as exempt income for expenditure incurred by an employee depends on various factors such as the extent to which the employee would be able to claim a deduction for the expenditure if the employee limitation did not apply. The deductibility test needs to be applied here.

As per IRD, for this determination to apply:

- An employer must make a payment to an employee

- The payment must be for expenditure or loss incurred or likely to be incurred by the employee

- The payment must be made because the employee is doing their job and the employee must be deriving employment income from performing their job.

- The expenditure or loss must be incurred by the employee in deriving their employment income and not be private or capital in nature

- The expenditure or loss must be necessary in the performance of the employee’s job

- The expenditure or loss must be incurred by the employee as a result of the employee being required to work from home because of the Covid-19 pandemic.

As per IRD, the determination does not apply to the following:

- Expenditure on account of an employee

- Any payments made for a period after an employee ceases to work from home

- An amount paid under a salary sacrifice arrangement

- To a payment made to an employee to compensate the employee for the conditions of their service.

Below is a summary of options available under Determinations EE001 and EE002 which details some of the costs the employers can pay the employees for and the tax treatments as per the IRD tax bulletin:

Please contact your GECA Advisor on 0800 758 766, if you are not sure of the tax treatment of the payments being made to your employees or if the payments exceed the thresholds outlined in the IRD determinations.

New 2020 Income Year – Kilometre rates for the Business Vehicles

If you are using your motor vehicle for business purposes, then you might want to claim the tax back on the expenses.

You are eligible to claim all the running costs for the motor vehicle if the vehicle is being used only for business purposes. However, if the vehicle is being used for both personal and business travel, then you will need to separate out the costs for each vehicle. Ways to claim business related costs are as per below:

- Claim actual costs relating to the vehicle by keeping accurate records. This will involve keeping detailed records for distances travelled and vehicle expenses for business related travel.

- Use a logbook to record distances travelled for all business trips and then calculate actual business use percentage for each period.

- Maintaining a logbook for at least 90 consecutive days to calculate the business use percentage. This can be used for the next three years. However, if you purchase a new vehicle, you will need to keep a log book again for at least 90 consecutive days again.

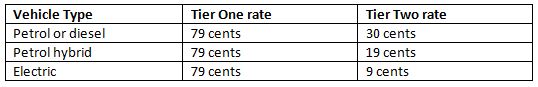

Once you have determined the business proportion of your vehicle, then the kilometre rates provided by the Inland Revenue can be used to calculate how much expenses can be claimed as follows:

- Tier One applies for the business portion of the first 14,000 km travelled by a vehicle in a year and is calculated as a combination of the vehicles fixed and running costs.

- Tier Two applies for the business portion of any travel in excess of the 14,000 kms and accounts for running costs only.

The current rates until further review are as follows:

If you operate under a company structure and use the company vehicle as a shareholder employee or provide vehicles for the staff to use, then you also need to be aware of the regulations relating to Fringe Benefit tax and whether it is applicable to your business.

Please contact your GECA Advisor on 0800 758 766, if you would like to discuss about whether to have the vehicle under your company structure, FBT implications, vehicle expenses you can claim or any other queries you may have.

Click here to add your own text