Xero Tips and Tricks: Simplifying Entertainment Expense Accounting

Nowadays many of our business meetings are held in cafes and restaurants. However, costs associated with these meetings are treated as entertainment and subject to 50% non-deductibility.

From an accounting perspective, typically entertainment expenses are treated as deductible during the year and then the 50% non-deductibility is applied as a year-end adjustment when preparing the annual accounts and tax return. However, this means your GST and profit and loss will be inaccurate during the year.

A more efficient procedure is to set up your accounting software to post entertainment expenses and automatically subject them to the non-deductibility adjustment at the time of recording the expense. Doing this will ensure you have an accurate Profit and Loss and file accurate GST returns during the year.

Read on to find out how Xero can be set up to do this for you.

First, think of using bank rules in Xero. It is a handy option for reconciling transactions that recognises expenses of similar nature and suggests how to code them. To set up a bank rule for your entertainment expense you need to:

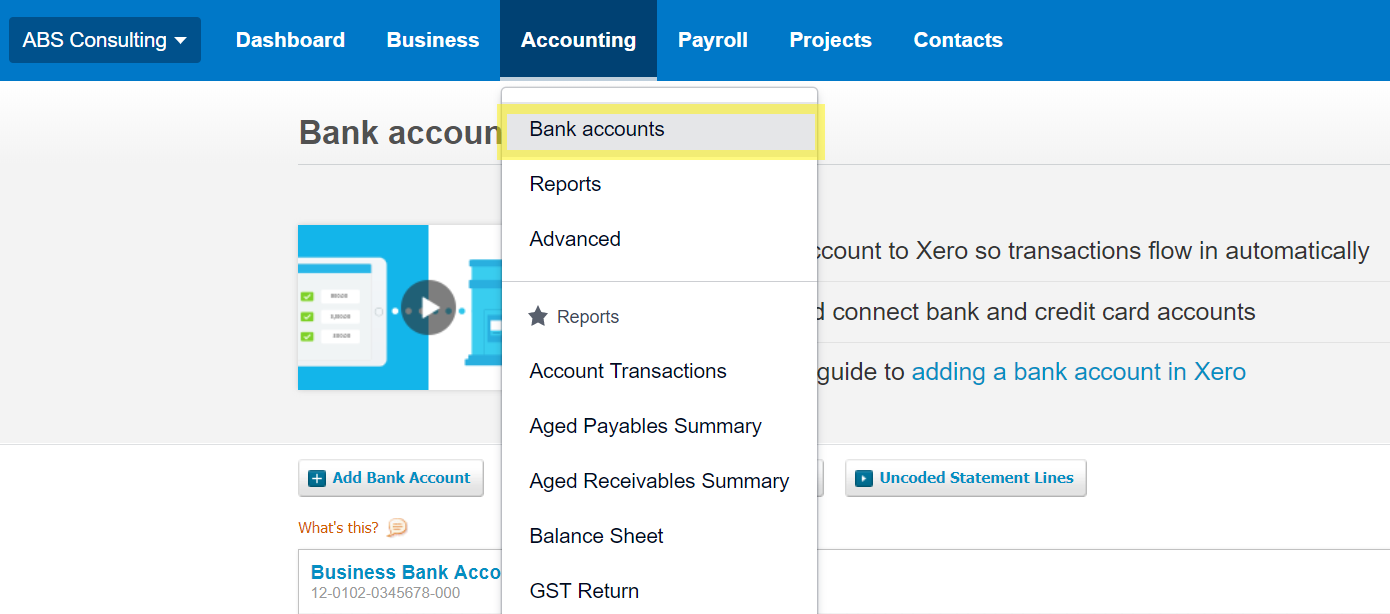

- In the Accounting menu, select Bank accounts.

- Click Bank Rules.

- Click Create rule, then select from Spend Money rule.

Now the most interesting part begins: we need to enter the conditions to make our entertainment expense bank rule work. These conditions will identify the bank transactions that our bank rule will apply to. At least one condition can be entered, apart from that you can have as many conditions as you want.

In this post I would like to show you some tips that will help Xero automatically identify and code the majority of your entertainment expenses.

- After selecting Spend Money rule choose “Any” option.

- The majority of places where you may entertain your clients and suppliers contain such words as “cafe”, “coffee” “bar”, “restaurant”, “kitchen”, “eatery”, or “pub” in their names. So including these words as conditions for entertainment expense bank rule can help Xero pick out the right transactions for you.

Please note that you should choose “contains” option as it allows you to include all the names that contain the necessary words regardless where they actually are. - Set the contact. Here I would recommend setting the contact as the Payee from the bank.

- Do not allocate fixed value line items since you probably don’t have them for entertainment expenses.

- Since in most cases New Zealand entertainment expenses incurred away from the office are only 50% deductible for income tax and GST purposes, they need to be split 50/50 between deductible entertainment and non-deductible entertainment. Some accountants do relevant tax adjustments at the end of year, however, you do have the option to do this throughout the year. Here is how you can do it while setting up bank rules in Xero:

Please note that you can have different codes for entertainment in your Xero Chart of Accounts. - Now you need to set up the reference. The default option may work well for this bank rule. Choose the bank account you would like to target with this rule. And finally give the created rule a title that can help you easily recognise it among other bank rules.

- Click Save and you are done with creating the rule.

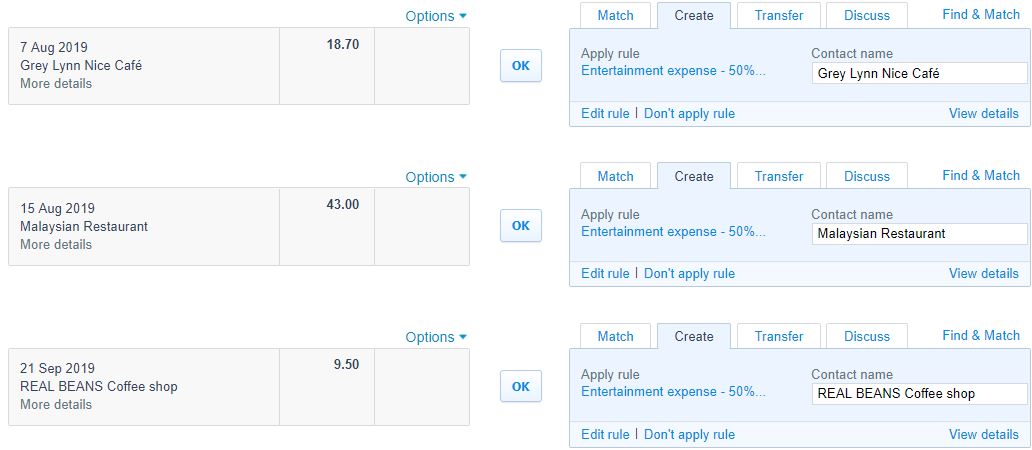

While reconciling next time you will see that Xero will automatically identify the majority of your entertainment expense and suggest you apply the created rule.

All you need to do is to check if this expense is truly 50% deductible and if so just click OK. If this expense was 100% deductible say it was a meal that you bought while travelling on business, you can choose to override the rule by simply clicking Don’t apply rule so you can code this expense manually.

The Author

The article is written by Valiya Gafarova, Certified Xero Advisor and Accountant at GECA Chartered Accountants. If you need any help with Xero feel free to get in touch with us on 0800 758 766.