Tax Tips

This post is by Giles Ellis, an experienced business coach and Director at GECA Chartered Accountants. GECA offer Accounting & Tax Advice and Business Advisory Services.

Inland Revenue have made some rates updates that we thought you might like to know about, these have been outlined below:

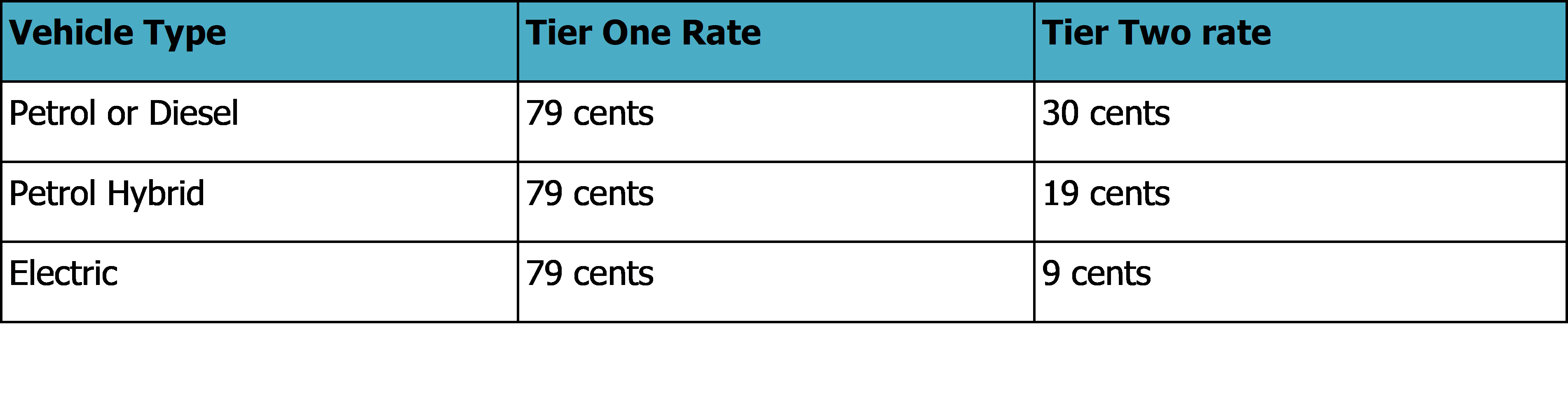

Motor Vehicles

The kilometre rates for 2019 are:

Tier One rates can be used for the first 14,000 kilometres of travel (for both business and private use), while Tier Two rates are used for travel beyond the first 14,000 kilometres.

Employees can be reimbursed using these rates, with Tier One rates available for the first 3,500 kilometres of reimbursement and Tier Two rates available for travel beyond the first 3,500 kilometres. Employees should keep a log book showing their business-related mileage. They can potentially claim a higher number of kilometres at the Tier One rate. For example, use the Tier One rate for the business portion of the first 14,000 kms (total) travelled by the vehicle in the income year, and then the Tier Two rates after that.

AA rates and actual costs can also be used as an alternate when claiming a deduction or reimbursement for a vehicle used for business purposes.

Home Office Deduction

The square metre rate for 2019 is $41.70 per square metre. The square metre rate can be used to claim a deduction where you use part of your house for business purposes. This excludes mortgage interest, rates or rent which can be claimed on a pro-rata basis as an additional deduction.

Money Interest Rates usage

From 29 August 2019, Inland Revenue use of money interest rates will be changing. The debit rate (the rate you pay to Inland Revenue) will be increasing from 8.22% to 8.35% per annum, while the credit rate (the rate Inland Revenue pays you) will be decreasing from 1.02% to 0.81% per annum.

Got a tricky tax problem, call us now on 0800 758 766 to see what we can do to assist. Alternatively, you can email support@geca.co.nz.

Download a pdf of the 2019 year-end tax tips

Credit: Information has been collated from www.ird.co.nz and excerpts from this article.