Providing entertainment while promoting business

You will never get a second chance to make a first impression. And yes, fortunately or unfortunately, a first impression is usually a long-lasting one and changing it can be a challenge. So when promoting your business, you want to make a good impression and be remembered in the right way. One of the ways to win over potential clients is through entertaining them in a social setting.

However, you need to remember that providing entertainment while promoting your business is subject to specific tax rules.

Promoting your business at events

The general rule is that promoting expenses that include entertainment are 100% deductible as long as the promotion addresses the general public, not particular people associated with the business.

For example, your company participates in a cultural festival and organises some entertainment for anybody who comes to the event. Say, people are offered some food, get involved in games and draw prizes. These expenses are fully deductible. However, if your existing business contacts, employees or somebody else has a greater opportunity to enjoy this entertainment than the general public these expenses will become only 50% deductible.

Let’s extend the example further. At this festival you distribute samples of your products or other freebies. You can deduct the 100% of the samples costs that have been given to the general public. However, if freebies are given to your employees or people associated with your business the expenses are just 50% deductible.

Promoting your business at conferences and educational courses

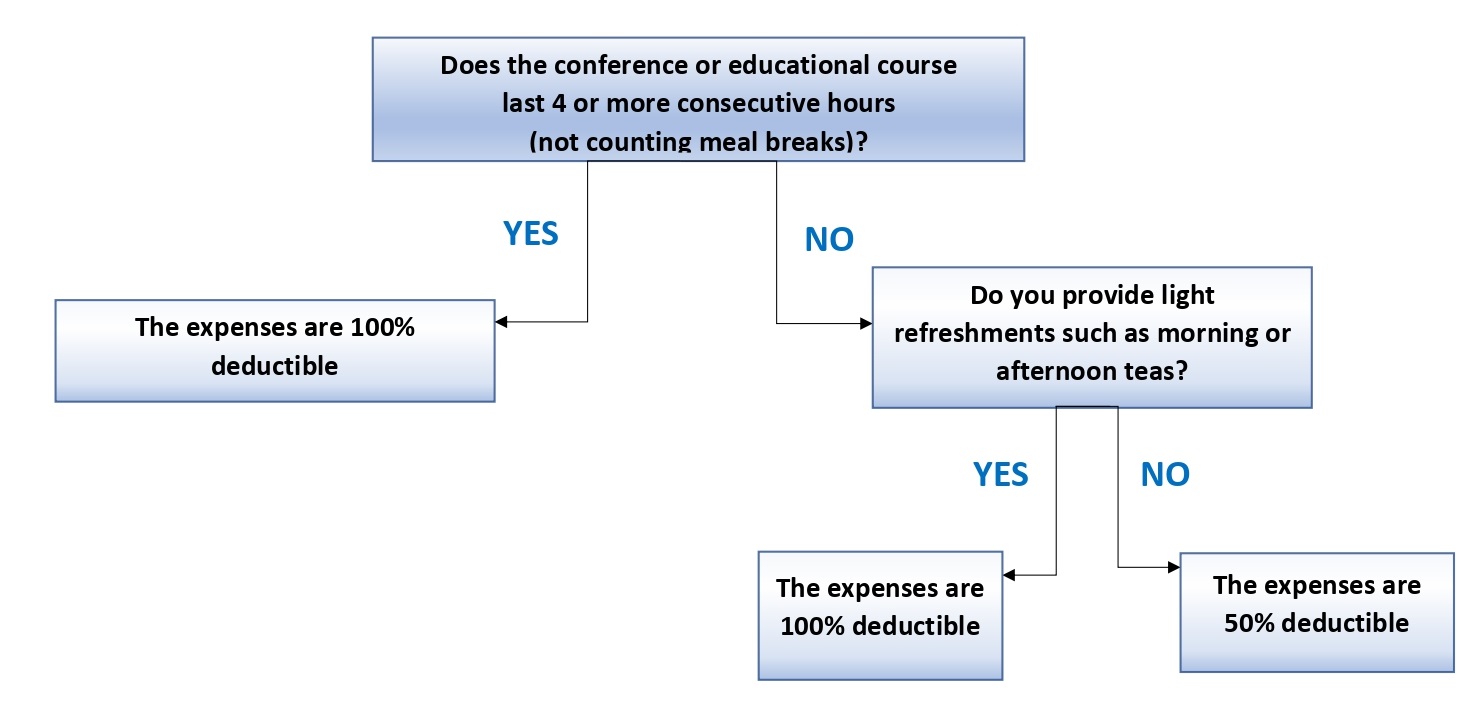

If the conference, educational course or other similar event is held for business purposes the deductibility of the expenses can be known using the following scheme.

Entertainment provided for the purposes of review to an external reviewer

If you are engaged in an entertainment business and you decide to render your services for free to a person who is going to review the entertainment, for income tax purposes you can deduct 100% of your actual expenses.

Say you run a tour around New Zealand. You invite a top blogger to enjoy the tour and write a review in his blog. The expenses associated with this tour including food and accommodation are 100% deductible.

Entertainment for charitable purposes

You can deduct 100% of your expenditures if your business provides entertainment for charitable purposes. The Charities Act 2005 says that ‘charitable purpose’ must fall under one or more categories:

- the relief of poverty;

- the advancement of education;

- the advancement of religion;

- other purposes beneficial to the community

For example, if you donate food to the Salvation Army the expenses are fully deductible.

Summary

When you do promotion and provide entertainment it is worth paying attention to who is going to enjoy the entertainment. If the entertainment is meant to be enjoyed by the general public more likely the expense is going to be 100% deductible.

The Author.

The article is written by Valiya Gafarova, Certified Xero Adviser and Accountant at GECA Chartered Accountants. If you want to know more about tax treatment of entertainment expenses feel free to get in touch with us on 0800 758 766.

Please note that this blog post should be considered as a general overview but not as a tax advice relevant to your situation.