Case Study: How Construct Brands excels with a GECA Virtual Finance Team

This post is by Giles Ellis, an experienced business coach and Director at GECA Chartered Accountants. GECA offer Succession Planning and other Business Advisory Services.

How GECA’s Virtual Finance

How GECA’s Virtual Finance Team solution set Construct Brands up for success

In today’s fast-paced business world, it can be small innovations that give companies an edge – and sometimes it’s an operational change that can make the most significant difference.

That’s what FMCG company Construct Brands has found with GECA Chartered Accountants’ Virtual Finance Team (VFT) service.

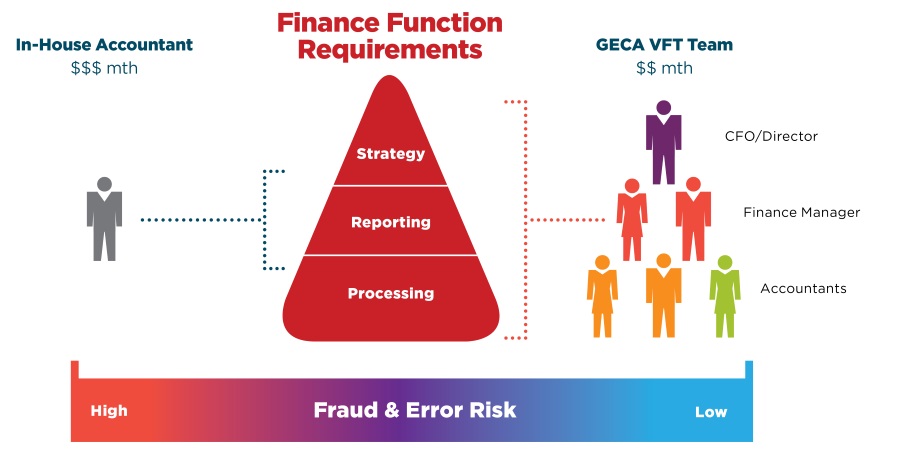

As GECA managing director Giles Ellis explains, the service doesn’t just remove the need for an in-house accountant. It also adds business-critical expertise, for a fraction of the cost.

“If you’re a business that’s big enough to hire an internal accountant, we can replace that person with our outsourced team – a finance manager, junior accountants, clerks, payroll experts and a CFO. That means you get all these specialised experts for less than you’d be paying a bookkeeper or junior accountant – who of course don’t have that breadth of experience.”

More business smarts for less

For Construct Brands, a company already steeped in innovation and with ambitious growth plans, that smarter way of working appealed. This FMCG company creates functional confectionary such as the Wolf Energy bars that are sold globally. When the company’s internal accountant resigned, the obvious next step was to recruit for the role – until the owner, Andy Smith, was told about GECA’s VFT offering.

For less than they were paying their accountant, GECA could deliver a much broader service and deeper expertise.

“We’ve replicated the functionality of internal accounting for less, but it’s not just about cost savings,” says Giles. “We’re reducing the risk of error and fraud. Management now also has access to advice, accountability and governance coaching, budgeting workshops, annual business plans that sync with the overarching plan – and we can help with them too.”

That support goes beyond numbers to upskill business owners in corporate governance and delve into the nitty-gritty of organisational structure.

“Often I find when a business is growing rapidly, people are thrown into the mix with no real structure,” says Giles. “We help make sure that there is a structure and that it’s fit for purpose – that’s all part of it.”

CEO, Andy Smith – “The biggest cost to us with an internal hire was our time. From hiring to managing the employee, it was time spent that we didn’t have. It’s been great to hand it all off to GECA and focus on the outputs instead.”

Seamless onboarding

Any operational change inevitably comes with a bit of upheaval as new systems are embedded. GECA’s propriety onboarding methodology is designed to minimise that.

“We’ve worked out how to do it seamlessly, with no interruption to the business,” says Giles.

The GECA team works alongside any incumbent staff, going through hand-over documents and procedures, so they’re across every detail of the function. From there they build a report of recommendation. For example, a plan for shifting to outsourcing the finance and accounting function, customised for that business.

“That customisation is key,” says Giles. “We want to make sure the new way of working will fit, and that the plan to move them over makes the most sense.”

“Like any major business system change, there has been pain, however effective communication during the transition process by the GECA team has minimised the impact on business.” Andy Smith, CEO.

Harnessing software

The GECA team then springs into action, establishing new procedures, software and integration, to deliver maximum efficiency. They moved Construct Brands from its legacy accounting package to the far more flexible Xero. That meant recoding year-to-date transactions in Xero. Then running parallel reports out of both systems to confirm the data accuracy of the starting position. In the process, they also simplified Construct Brands’ invoicing process, which has to factor in three different services.

“Just that shift has delivered the business a real efficiency boost – where before each invoice had to be manually input, now Xero auto-creates many of them” explains Giles.

Accounts payable is also a lot tidier and easier to manage.

“They had a folder of paper receipts, including printed out electronic invoices. Inefficient, costly and wasteful. Now we’ve implemented Receipt Bank, which lets you scan any invoices, which are sent to Xero to be coded. That means each transaction has a receipt recorded next to it, which allows efficient compliance with the IRD document-keeping requirements says Giles.

“We love being able to photograph those annoying coffee receipts from our phones for easy expense reimbursement.” Andy Smith.

A shift from paper to Smart Payroll has also saved days of work each month. Instead of filling in paper forms, staff can now use an app to apply for leave. Then with a few clicks, managers approve it.

“It goes straight through,” says Giles. “It’s also very fast and accurate. Where they were spending two to three days a month preparing payroll, now that’s a matter of a couple of hours.”

More Effective Reporting

As part of the onboarding process, the GECA team review all current management accounting reports against reporting metrics used by similar businesses. They then compare them against functionality available from the newly implemented systems. This informs the recommendations they can make to enhance the reports.

Of most value though, is the monthly CFO Report, which provides a financial summary to the management team. This includes valuable insights and analysis from experienced management accountants and analysts. It covers off all aspects of the VFT service including Financials, Cashflow, Payroll, Creditors and Debtors.

Improved Governance

So often, business owners understand how important a strong governance framework is for increasing business value. However, day-to-day operational issues mean this vital business function is neglected. The GECA VFT service includes regular Advisory Board meetings, chaired by the Virtual CFO who is also an experienced Director, using insights and analytics provided by the GECA VFT.

“It’s been great having Giles challenge our thinking which had been entrenched over many years and we value the insights he brings from his work with other clients in the FMCG space.” Andy Smith

For medium-sized business, delivering that all-important edge doesn’t have to come from a cornered market or trademarked products. Clever ways of working – like GECA’s VFT service – can mean smaller businesses are operating with the efficiencies and expertise you’d expect from much larger businesses. People at every level can work faster and smarter, and the business is set up for future growth.