This post is by Sheral Reddy, an chartered accountant and tax specialist at GECA Chartered Accountants. Call Sheral now for tax advice on your circumstances.

On 23rd of March 2021, the government announced various policies which will impact the property owners and investors significantly which was passed on 24 March and received the royal assent on 30 March 2021. The policies have been aimed at the housing market as result of the soaring house prices and the changes are to make the property market more accessible to the first home buyers.

The changes announced are as follows:

- Bright-line Test Extension to 10 Years

- The bright-line test taxes capital gain from the sale of residential properties if they are sold within a set time frame.

- Any properties acquired on or after 27 March 2021, except for new builds will be subject to the bright-line period of 10 years (previously 5 years)

- If the property is sold within the 10-year period after acquisition, the owners and investors will be required to pay income tax on any profit from the sale of the property.

- Any ‘new builds’ will still be subject to the bright-line period but only for 5 years. The definition of a ‘new build’ is still to be clarified but includes properties that are acquired within a year of receiving their code of compliance certificate.

- Inherited Properties remain exempt from the bright-line test.

- Generally, for tax purposes the date of acquisition is when the date that a binding sale and purchase agreement is entered into. However, under the Bright-line tests, the commencement date is when the legal title is acquired and the end date is when the binding sale and purchase agreement to sell is signed.

- In cases where there is no title obtained once a sale and purchase agreement is signed, then the bright-line test will commence on the date the sale and purchase agreement was signed. This usually applies where the land was sold later before the title to the land was issued to the vendor in property transactions such as the off-the plan purchases.

- Changes to the ‘Main Home’ Exemption

- In the past any properties used as the main home was exempt from the bright-line test. You had to have lived in the property for more than 50% of the time of total ownership and more than 50% of the total floor area of the house had to be used as the main home. Having a ‘main home’ exemption in the past meant that there was no tax on gain on sale of your main home.

- However, the ‘main home’ exemption rules for properties purchased from 27 March 2021 and onwards have now changed. The gain on sale relating to the period of ownership where the property was not used as a main home will now be taxable (apportionment rules will apply). For example, if the property was rented out for two years and lived in it for the six year before being sold. The gain on sale will be taxable for the 2 years it was rented out of the total 8 years. This also applies to and includes new builds.

- Interest Deductibility Rule changes on Residential Properties

- In the past Interest on mortgages relating to the residential rental properties have been deductible as an expense against the rental income for tax purposes. This allowed property owners and investors to reduce their tax liability on the rental property. The new policies will not affect property developers or loans for non-housing business purposes. However, the following changes will take effect as follows:

- Properties acquired on or after 27 March 2021 will not be allowed to claim interest expenses on the mortgages against the rental income incurred after 1 October 2021

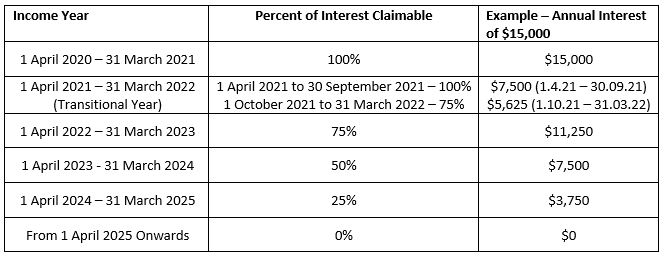

- For existing rental properties purchased before 27 March 2021, will have their interest deductions phased out over four years as shown in the example below:

- In the past Interest on mortgages relating to the residential rental properties have been deductible as an expense against the rental income for tax purposes. This allowed property owners and investors to reduce their tax liability on the rental property. The new policies will not affect property developers or loans for non-housing business purposes. However, the following changes will take effect as follows:

In Summary

Please note, the new legislation does not affect the ring-fencing of rental losses. Any rental losses will continue to be ring-fenced and be offset against any future rental income from residential rental activities.

The changes mentioned above will have a significant impact on property investors and owners. The deductibility rules on interest on mortgage will impact the tax liabilities of investors going forward. Especially with the new tax rate of 39% for individuals earning $180,000 and over. We suggest, making an appointment with us to review the structure of your investment properties as soon as possible.

Please contact your GECA Advisor on 0800 758 766, if you would like to discuss about the how the new tax changes mentioned above would impact you. We would be happy to assist you with reviewing the structure of your residential rental properties and the preparation of your rental accounts or income tax returns.