https://geca.co.nz/wp-content/uploads/2025/05/2020-09-10.webp

454

680

Giles

https://geca.co.nz/wp-content/uploads/2018/09/geca-chartered-accountants-newzealand.jpg

Giles2025-05-27 17:04:272025-05-29 17:11:46Key Facts and Updates About New Zealand Tax Returns for 2025

https://geca.co.nz/wp-content/uploads/2025/05/2020-09-10.webp

454

680

Giles

https://geca.co.nz/wp-content/uploads/2018/09/geca-chartered-accountants-newzealand.jpg

Giles2025-05-27 17:04:272025-05-29 17:11:46Key Facts and Updates About New Zealand Tax Returns for 2025Benefits of KPI Improvement Coaching

Anytime is the right time to start working on your business KPIs. It’s easy to make excuses such as ‘I’m too busy working in the business right now to devote any time to working on this stuff’. The reality is however that if you allocate a little time each week to improving your business performance, the time investment will make a big difference to both your business and personal life.

- Set sensible targets for improving 3-5 critical KPIs

- Streamlineand establish the processes that will improve your KPIs

- Increased efficiency and productivity

- Clarify performance expectations with your Team

- Manage your Team more effectively, manage by fact

- We’ll encourage you to be accountable for your goal achievement

- Be inspired to work less inthe business and more onit

- Gain access to our collective wisdom, our systems, products and services

- Gain better understanding of how your business operates

- Increase your ability to make effective strategic decisions

About Our KPI Improvement Coaching

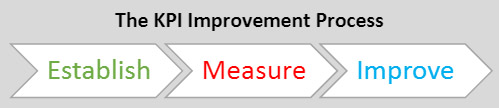

The better you understand your business, the easier it will be to increase your profits and free up cashflow. We’ve developed this service to enable business owners to work out what the key drivers are in their business (we call these Key Performance Indicators, or KPIs).

We want you to learn how to measure them accurately, then apply strategies and tactics to improve each KPI.

What is Involved?

First we work together to establish the key drivers in your business. These may be financial, e.g. gross profit margin or average annual customer spend, or non-financial e.g. customer satisfaction ratings.

Then we teach you how to measure each KPI and track them via a cloud based performance dashboard. We like to limit the number of KPIs you’re monitoring to the most important ones (the ones that will make the most powerful difference to your business). Once you’re confident measuring each key driver accurately, we’ll work with you on a monthly basis to form a tactical plan that includes all of the business processes and behavioural changes needed to improve your results. It’s remarkable how simple changes to your business processes can improve your key drivers. What you measure you can manage.

This Workshop has qualified for the NZTE Capability Development Voucher Scheme. Please enter your voucher details when making your booking. We will verify your voucher with the Issuing Regional Partner before confirming your place on the course. For more information on the NZTE Capability Development Voucher scheme or to find your local Regional Business Partner click here

KPI Improvement Coaching – 25% Discount!

This comprehensive KPI Improvement Coaching is valued at $1,950 +GST. Call today and receive our promotional offer of $1,495 +GST – Phone 0800 758 766.